Blockchain technology has been widely implemented across various business domains because of its helpful features, such as storing and recording transactions securely. Real estate is no exception since this area can benefit from improved transparency, reduced fraud, and enhanced efficiency.

This post discusses the impact of Blockchain on real estate and the prospects it may create. We’ll also explore key considerations for an excellent real estate project and examine some thriving startups.

Blockchain in Real Estate: Major Benefits to Find Out

Blockchain offers significant advantages for real estate, transforming overall workflow. Let’s take a closer look at them:

Cost-effectiveness

Adopting a decentralized chain decreases transaction prices by eliminating third-party participants, paperwork, and manual reports. Moreover, employing blockchain smart contracts automates administrative duties, lowering the overhead of outsourcing and paperwork.

Transparency

Blockchain is a transparent and unchangeable ledger that allows real-time recording and verification of transaction data. It increases trust between stakeholders by providing better visibility of records. Thus, it is the best solution for secure and fine operations.p>

Enhanced data protection

Blockchain provides strong protection and a secure foundation for real estate operations using cryptographic methods and decentralized networks, lowering the likelihood of fraud and unauthorized changes. Technology protects, reduces possible risks, and provides a secure basis for real estate transactions.

Increased due diligence and compliance

Blockchain in real estate purchases guarantees correct due diligence records and clearness. It allows buyers to verify important aspects such as ownership history, title authenticity, and regulatory compliance. The decentralized ledger provides a secure and tamper-proof source of information that relevant parties can easily access. This helps Know-Your-Customer (KYC) and Anti-Money Laundering (AML) measures, making identifying potential threats easier and preventing fraudulent activities.

Globalization of investment

Blockchain guarantees seamless cross-border dealings through tokenization and digital asset exchanges, giving investors entrance to global real estate markets and facilitating portfolio expansion and diversification.

Crowdfunding opportunity

Startups can engage a wider pool of possible investors, overcoming traditional barriers to entry. Thanks to crowdfunding platforms powered by decentralized technology, investors worldwide can participate in projects they are interested in by contributing small shares of capital. This democratization of investment diversifies funding sources and promotes community engagement and support for local development initiatives.

Investment liquidity

Blockchain presents tokenization, representing real estate assets as digital tokens on a decentralized network. Tokens can be bought, sold, and exchanged on digital asset exchanges, equipping investors with greater scalability and liquidity.

Blockchain Real Estate Startups Examples

Blockchain startups are using this innovative technology to modernize real estate. Here’s a quick overview of some successful projects:

- Ubitquity: A platform delivering blockchain-based solutions for secured and efficient property record administration.

- ManageGo: A rental management platform using Blockchain for safe transactions and translucent record-storing.

- Harbor: Focuses on tokenizing private securities, such as real estate, to complete compliant trading on the Blockchain.

- SafeWire: Using Blockchain to prevent wire fraud enhances real estate transaction security.

- RealT: A platform that tokenizes real estate properties, providing fractional rights and investment opportunities.

- Blocksquare: Provides tokenization technology for real estate assets, enabling seamless property transactions on the blockchain.

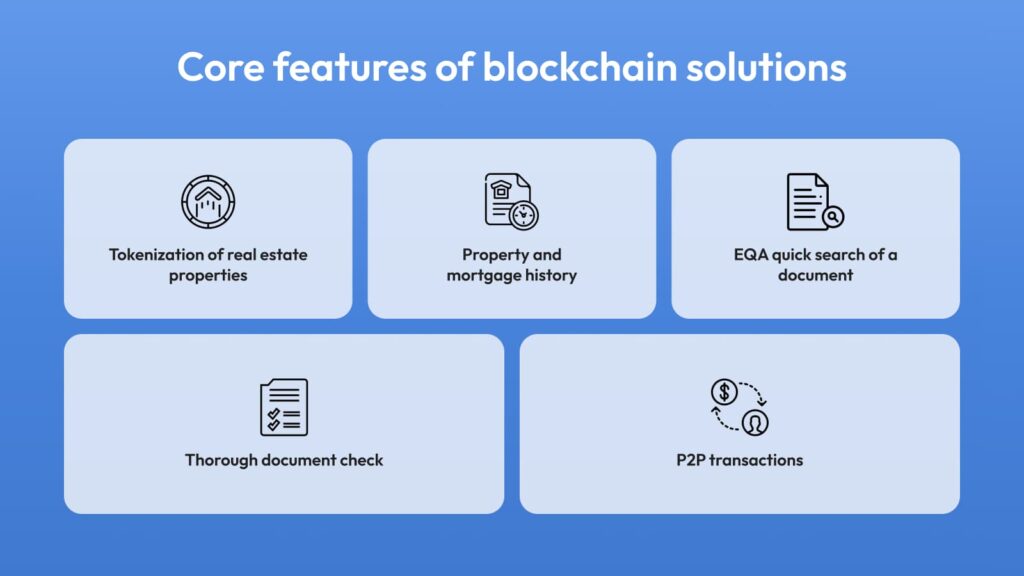

How to Integrate Blockchain in Real Estate Solutions

Here’s a breakdown of points you need to know to integrate blockchain solutions successfully :

Identify key areas for Blockchain integration

Start by identifying specific areas where Blockchain can add value to your real estate operations. Common use cases include:

- Property transactions

- Rental deals

- Lease administration,

- Real estate crowdfunding and investment,

- Property management a

- Maintenance records

Select the right blockchain platform

Next, pick a platform that aligns with your business requirements. Popular options include Ethereum, Hyperledger, and Corda. Each platform has advantages, so consider scalability, security, and ease of use.

Develop smart contracts

Once the platform is chosen, develop smart contracts for various processes. Smart contracts are self-executing contracts with terms directly written into code. They automate operations and cancel the need for intermediaries. Key applications include property sale and purchase agreements, rental contracts, lease management, and investment and crowdfunding agreements.

Ensure regulatory compliance

Ensuring regulatory compliance is essential for Blockchain in real estate. Cooperate with legal experts to ensure your solutions adhere to local and international property laws, data protection regulations like GDPR, and anti-money laundering (AML) and know-your-customer (KYC) requirements.

Integrate with existing systems

Seamlessly integrating Blockchain with your existing real estate systems is another vital step. This may involve connecting it to your property management software, integrating it with financial systems for payment processing, and ensuring interoperability with other industry platforms.

Implement robust security measures

Security is crucial. Utilize reliable security measures to protect sensitive data, such as using encryption to secure data on the Blockchain, implementing multi-signature wallets for transactions, and regularly auditing smart contracts and code.

Monitor and optimize

Finally, constantly monitor the performance of your blockchain integration. Gather user feedback to find out what areas need improvement. Optimize processes and update smart contracts as needed to enhance functionality and efficiency.

Key Considerations for Successful Implementation

Integrating blockchain technology into real estate software can revolutionize operations and offer significant advantages. However, careful consideration of several key factors is required.

Choosing the right development approach: Determine whether to develop the solution in-house or outsource to a qualified software development team. This decision should be based on budget, expertise, and timelines.

Identifying core functionality requirements: Define the essential features to meet business objectives, such as property listing, offer management, escrow services, and transaction tracking.

Technical implementation: Evaluate blockchain platforms like Lisk or Ethereum and consider leveraging JavaScript or smart contracts to build secure and efficient real estate solutions.

Conclusion

Blockchain technology addresses many of the long-standing challenges in the real estate sector. Its security, transparency, and efficiency can significantly improve transactions, streamline operations, and open investment opportunities. Adopting this innovation can increase accessibility, trust, and overall betterment in real estate.

Comments are closed